Editorials

Bernard-Louis Roques

Bernard-Louis Roques

General Partner

& co-Founder,

Truffle Capital

It's that time of year again, when we produce the Truffle 100, search and share the data, an opportunity to reconnect with the stakeholders of the industry. I guess the Truffle 100 has found its place in the European business environment and brings its contribution to the software ecosystem.

You are more than 100,000 to use this free research as a tool, a barometer, a source of data to increase your knowledge and enrich your vision of the European software market. Truffle Capital, CXP and IDC are happy to provide you this service, with the support of the European commission and ESSEC Business School.

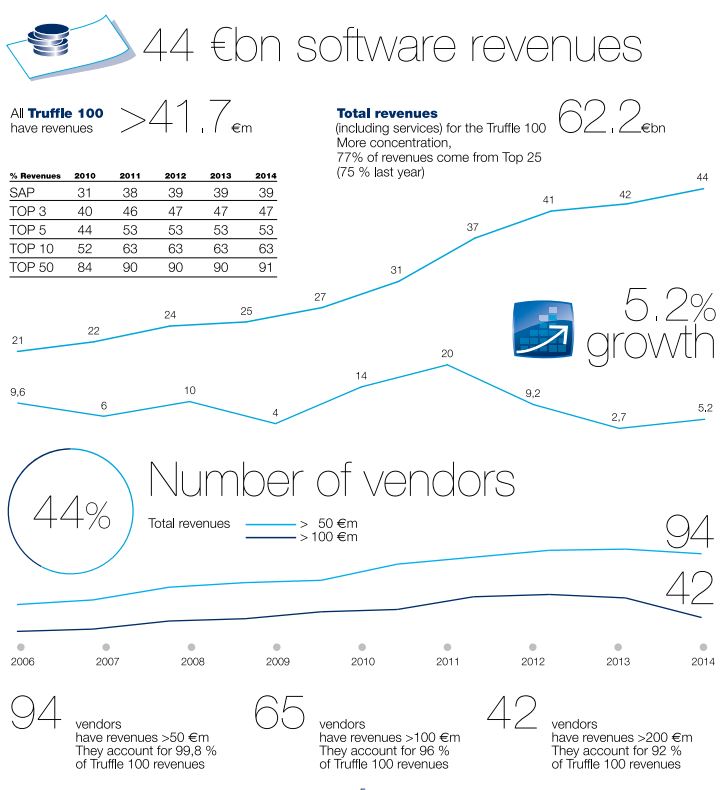

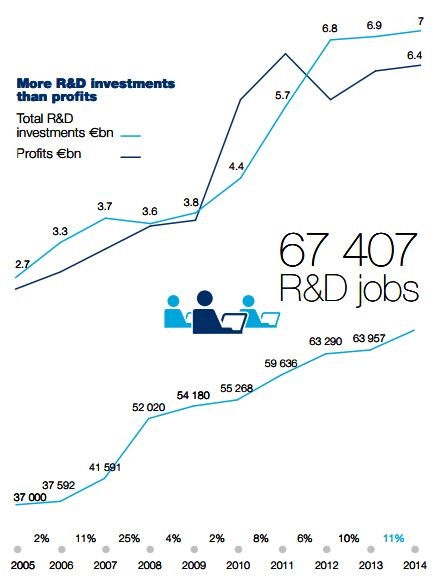

With €44 billion in aggregated revenues, 67,000 R&D jobs, 5.2% growth and €7 billion invested into research, the software vendors have become a major component of the European economy and the most important contributor to its innovation.

On the eve of major paradigm changes driven by mobility, cloud computing, applications, they are going through challenging but thrilling transformations. We're experiencing one of the most exiting chapters of the industry's history, and remain reasonably optimistic, betting on the proven resilience and innovative agility outlined year after year in all the Truffle 100 search

Laurent Calot

CEO,

CXP Group

We have entered the digital age and there is no turning back. Although not all businesses have made the transition yet, there is now real awareness, shared by everyone, of digital considerations. In sectors such as distribution and finance and in the B2C sector, digital technologies are already revolutionising the way in which businesses interact with their customers. Digitalisation is transforming the value chains of businesses, their business models and their ecosystems. Adopting and making optimum use of technologies, such as cloud computing, mobile technologies, analytics or the Internet of Things, make new business objectives possible. Digitalisation throws the doors wide open to innovation and new projects.

To meet these potentially huge challenges, the software industry is adapting; the European Truffle listing is proof of this. The new solutions offered integrate SMAC (Social, Mobile, Analytics, Cloud) technologies to meet the demand of business users who now require customer-oriented, web-designed tools, access to mobile applications, agile management tools, visual and easy-to-interpret dashboards, and analysis functions capable of deriving value from increasingly large and less structured sets of data. Software publishers have realised that cloud infrastructures and SaaS applications now represent the strongest market driver (with growth rates of between 30% and 40%) and are revising their business models to base their growth on recurring turnover. Finally, software vendors, integrators, service companies and cloud brokers are working to provide a high value-added, business-oriented "service" dimension which will make the difference, boost the competitiveness of businesses and accelerate their modernisation.

Bo Lykkegaard

Associate Vice

President, European

Software Research,

IDC

2014 was a year of solid growth overall for Europe's software industry. It was also a year of change, as an increasing proportion of top 100 vendors made significant bets on new cloud businesses to complement their traditional software businesses. IDC estimates that just under half of the top 100 software providers have built or acquires significant cloud offerings today. For those vendors, cloud has moved beyond the trial-and-error state into mainstream business. The ones that have moved first are typically vendors of horizontal business applications, such as marketing, CRM, Human Capital Management, accounting, etc. Three top vendors, SAP, Dassault, and Sage, have each made significant advances in cloud computing.

The question that arise is then: What about the vendors that have not yet made a significant bet in cloud. IDC research shows that different software areas have different level of cloud maturity and hence different urgency of business model transformation. Many industry-specific packaged software applications are replacing custom software or manual processes. They are not at a level of standardization to warrant a software-as-a-service approach. However, IDC believes that by 2020 cloud computing will cover the majority of IT workloads, even in large enterprises. Consequently, all software vendors in Europe must consider the cloud computing model at some point in their planning horizon.

The transition to cloud and major disruptive computing trends, such as mobile applications, real-time analytics, and internet of things, is complex and costly and carries a risk of cannibalizing existing revenue streams from software licenses and maintenance contracts. However, staying abreast of disruptive technology developments is vital for the longer-term sustainability of the European software industry and strong linked to R&D investments and access to capital. For those making the leap, the future holds promises and growth opportunities.

Karl-Heinz Streibich

Chief Executive Officer,

Software AG

Digitization is changing everything. It is impacting every industry and opening huge new business opportunities for any enterprise that reacts quickly enough with an imaginative and innovative digital strategy. It is having a positive impact on the lives of billions of citizens worldwide through better managing health services to streamlining the use of global resources.

At a national economic level the impact is startling. According to the World Economic Forum , a 10 percentage point increase in a country’s digitization index can result in a 0.75% rise in GDP and a 1.02% drop in unemployment. More tangibly, IDC forecasts that the worldwide market for Internet of Things solutions will grow from $1.9 trillion in 2013 to $7.1 trillion in 2020. This is simply the largest growth phase in history.

The growth potential for the Industrial Internet should be music to European ears. It is imperative that Europe leverages its unequalled engineering heritage to spearhead the Industrial Internet. Europe must ensure that it makes an impact in this digital revolution that reflects and builds on its manufacturing economic might.

Digitization is changing everything. Europe has to be at the forefront of this change.

Figures

- Revenues

-

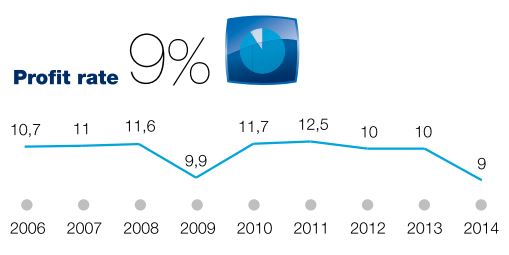

Profits

Profits 2008 2009 2010 2011 2012 2013 2014 % of revenues T 100 SAP 51 46 31 52 48 52 51 39 TOP 3 62 58 40 60 58 59 60 47 TOP 5 67 66 44 66 65 67 68 53 TOP 10 67 66 52 79 79 79 80 63 TOP 50 92 91 84 96 95 97 97 91

The bigger, the more profitable

Profitability % of revenues Profits €M 2013 2010 2011 2012 2013 2014 TOP 3 15.2 22.9 17.0 18.5 17.7 3804 TOP 25 12.0 12.9 11.7 5301 TOP 50 12.2 13.5 10.8 12.1 11.1 6174 BOTTOM 50 10.6 5.2 4.6 2.6 3.2 201 BOTTOM 25 13.4 6.9 6.8 7.9 2.3 40

Profit rate

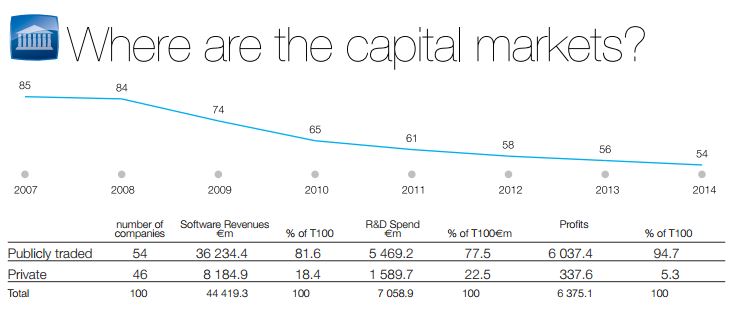

Publicly traded

-

Breakdown by country

Top five countries in Europe represent 53% revenues

Country 2011 2012 SW revenues (€M) 2013 2014 % of total # SW companies Germany 18 145.7 20 328.6 21 046.4 22 139.7 49.8 17 UK 5 497.3 5 994.6 5 406.8 5 524.1 12.4 19 France 4 040.9 4 348.9 5 028.5 5 433.0 12.2 22 Sweden 2 163.5 2 326.5 2 392.0 2 434.5 5.5 7 Netherlands 2 187.9 2 236.2 2 103.7 2 223.9 5.0 7 Poland 1 005.5 1 152.4 1 229.1 1 384.8 3.1 2 Switzerland 1 110.8 1 208.2 1 174.6 1 319.9 3.0 5 Norway 486.2 544.8 639.2 688.5 1.5 3 Italy 516.5 557.3 625.8 687.0 1.5 3 Belgium 530.1 594.9 580.2 596.8 1.3 1 Finland 618.1 625.0 656.6 568.3 1.3 5 Czech Republic 248.5 361.9 375.9 444.7 1.0 2 Denmark 194.4 287.0 303.0 353.5 0.8 2 Slovakia 149.1 256.4 301.4 328.8 0.7 1 Austria 116.4 126.3 120.3 162.7 0.4 2 Spain 176.7 198.4 189.2 129.2 0.3 2 Total 37 187.7 41 147.7 42 172.6 44 419.3 100.% 100

World-class national champions

Vendor Country Revenues (€M) % of T100 SAP DE 17 244 38.8 Dassault Systemes FR 2 079 4.7 Sage UK 1 540 3.5 Hexagon SE 1 442 3.2 Wincor Nixdorf DE 1 367 3.1

R&D and Jobs

Top 5 countries represent 84% of total R&D jobs

| Countries | Number of R&D employees | % of total | R&D investment (€M) | % of total |

|---|---|---|---|---|

| Germany | 25 654 | 38.1 | 2 966.8 | 42.0 |

| UK | 7 520 | 11.2 | 915.6 | 13.0 |

| France | 12 374 | 18.4 | 1 066.5 | 15.1 |

| Sweden | 4 799 | 7.1 | 461.9 | 6.5 |

| Netherlands | 5 534 | 8.2 | 700.4 | 9.9 |

| Poland | 4 198 | 6.2 | 130.7 | 1.9 |

| Switzerland | 1 052 | 1.6 | 155.7 | 2.2 |

| Norway | 1 170 | 1.7 | 142.1 | 2.0 |

| Italy | 1 575 | 2.3 | 97.8 | 1.4 |

| Belgium | 493 | 0.7 | 69.0 | 1.0 |

| Finland | 824 | 1.2 | 101.6 | 1.4 |

| Czech Republic | 712 | 1.1 | 78.1 | 1.1 |

| Denmark | 638 | 0.9 | 76.5 | 1.1 |

| Slovakia | 382 | 0.6 | 36.2 | 0.5 |

| Austria | 194 | 0.3 | 25.2 | 0.4 |

| Spain | 290 | 0.4 | 34.8 | 0.5 |

| Total | 67 407 | 100.0 | 7 058.9 | 100.0 |

Major M&A transactions

2014

- Advent International acquired Unit4

- Autodesk acquired Delcam

- Automic acquired Orsyp

- COR&FJA changed name to msg life AG

- Dassault Systemes acquired Accelrys

- Dassault Systemes acquired Quintiq

- Dassault Systemes acquired SimPack

- Hexagon acquired Devex

- Hexagon acquired iLab Sistemas

- Hexagon acquired Mintec

- Hexagon acquired North West Geomatics

- Hexagon acquired Vero Software

- KKR reduced ownership of Visma from 76% to 31.3%, HgCapital increased from 16% to 31.3%, and Cinven acquired 31.3%.

- Lexmark acquired ReadSoft

- Misys acquired Custom Credit Systems

- Misys acquired IND Group

- Northgate Information Solutions sold off its Public Services division to Cinven

- Opera Software acquired AdColony

- Sage acquired PayChoice

- SAP acquired Concur

- SAP acquired Fieldglass

- SAP acquired SeeWhy

- Schneider Electric acquired Invensys

- Software AG acquired JackBe

- Software AG sells off IDS Scheer Consulting to The Scheer Group

- Sopra Group acquired the COR&FJA Banking Solutions

- Sopra Group acquired Steria

- Wincor Nixdorf acquired Datec Retail Systems

2015

- Apax acquired Exact

- Asseco Group acquired Exictos SGPS

- AVG Technologies acquired Norman Safeground

- Bridgepoint acquired eFront

- Cegedim sold off CRM solutions to IMS Health

- Compugroup Medical acquired Medicitalia

- Dassault Systèmes acquired Modelon

- GAD merged with Fiducia and changed name to Fiducia & GAD

- Gemalto acquired Safenet

- Hexagon acquired Ecosys

- Hexagon acquired Q-DAS

- IFS acquired VisionWaves

- InfoVista acquired Ipanema Technologies

- Keysight Technologies acquired Anite

- Lexmark acquired Kofax

- Microfocus acquired Attachmate

- Permira acquired TeamViewer from GFI Software

- Qlik acquired Vizubi and NPrinting

- Unit4 acquired Three Rivers Systems

- Visma acquired e-conomic

- Vista Partner acquired Advanced Computer Software

- Wincor Nixdorf acquired services business from Brink

- Wolters Kluwer acquired Effacts Legal Management Software

- Wolters Kluwer acquired SureTax

European software vendors ranking 2015

| Rank | Company | Country of HQ location |

Public | Software +Services 2014 (m€) |

Total revenues 2014 (m€) |

R&D employees 2014 |

| 1 | SAP | DE |  |

17 243.9 | 17 560.0 | 18908 |

| 2 | Dassault Systemes | FR |  |

2 078.6 | 2 346.7 | 5562 |

| 3 | Sage | UK |  |

1 539.5 | 1 620.5 | 1169 |

| 4 | Hexagon | SE |  |

1 442.3 | 2 622.4 | 3430 |

| 5 | Wincor Nixdorf | DE |  |

1 367.0 | 2 471.0 | 750 |

| 6 | Asseco Group | PL |  |

1 193.3 | 1 487.6 | 3696 |

| 7 | Software AG | DE |  |

835.6 | 857.8 | 968 |

| 8 | DATEV | DE | 790.7 | 843.5 | 1355 | |

| 9 | Wolters Kluwer | NL |  |

740.2 | 3 660.0 | 2222 |

| 10 | Misys | UK | 639.5 | 639.5 | 1100 | |

| 11 | Micro Focus | UK |  |

627.9 | 627.9 | 897 |

| 12 | SWIFT | BE | 596.8 | 628.0 | 493 | |

| 13 | Unit4 | NL | 516.0 | 516.0 | 1380 | |

| 14 | Visma | NO | 464.7 | 851.7 | 730 | |

| 15 | Cegedim | FR |  |

460.6 | 911.5 | 959 |

| 16 | Sopra Steria | FR |  |

445.4 | 3 370.0 | 800 |

| 17 | Qlik | SE |  |

418.9 | 418.9 | 358 |

| 18 | Avaloq | CH | 411.6 | 411.6 | 300 | |

| 19 | Swisslog | CH |  |

411.4 | 551.3 | 146 |

| 20 | Northgate Information Solutions | UK | 373.7 | 826.0 | 600 | |

| 21 | Fiducia & GAD | DE | 369.3 | 458.4 | 220 | |

| 22 | Compugroup Holding | DE |  |

368.8 | 515.1 | 1426 |

| 23 | Murex | FR | 368.0 | 368.0 | 386 | |

| 24 | Temenos | CH |  |

352.6 | 352.6 | 441 |

| 25 | Fidessa | UK |  |

341.0 | 341.0 | 437 |

| 26 | Gemalto | NL |  |

333.9 | 2 465.0 | 1105 |

| 27 | IFS | SE |  |

333.4 | 333.4 | 333 |

| 28 | ESET | SK | 328.8 | 328.8 | 382 | |

| 29 | Zucchetti | IT | 310.3 | 358.0 | 900 | |

| 30 | Schneider Electric | FR |  |

304.1 | 1 713.0 | 565 |

| 31 | Reply | IT |  |

287.0 | 632.2 | 390 |

| 32 | Sophos | UK |  |

285.0 | 285.0 | 608 |

| 33 | AVG Technologies | CZ |  |

281.5 | 281.5 | 482 |

| 34 | Centric | NL |  |

275.2 | 494.5 | 146 |

| 35 | Axway | FR |  |

261.6 | 261.6 | 650 |

| 36 | AVEVA Group | UK |  |

258.8 | 258.8 | 562 |

| 37 | Cegid | FR |  |

243.0 | 266.6 | 546 |

| 38 | Civica | UK | 242.5 | 272.8 | 236 | |

| 39 | SimCorp | DK |  |

241.1 | 241.1 | 448 |

| 40 | Kofax (now part of Lexmark) | UK |  |

222.0 | 222.0 | 413 |

| 41 | Nemetschek Group | DE |  |

218.3 | 218.5 | 605 |

| 42 | Advanced Computer Software | UK | 217.0 | 273.4 | 238 | |

| 43 | Comarch | PL |  |

191.5 | 247.9 | 502 |

| 44 | Exact | NL |  |

188.1 | 188.1 | 454 |

| 45 | Avast Software | CZ | 163.3 | 163.3 | 230 | |

| 46 | PSI | DE |  |

158.1 | 175.4 | 264 |

| 47 | Linedata Services | FR |  |

158.0 | 158.0 | 408 |

| 48 | Haufe Group | DE | 154.5 | 278.7 | 260 | |

| 49 | F-Secure Corp. | FI |  |

153.8 | 153.8 | 134 |

| 50 | SDL International | UK |  |

142.1 | 322.9 | 255 |

| 51 | Prodware | FR |  |

139.0 | 174.4 | 274 |

| 52 | RM | UK |  |

134.5 | 248.0 | 109 |

| 53 | Teamviewer | DE | 119.9 | 119.9 | 120 | |

| 54 | Opera Software | NO |  |

117.3 | 361.7 | 300 |

| 55 | Affecto | FI |  |

116.0 | 122.7 | 82 |

| 56 | BasWare | FI |  |

115.4 | 127.7 | 332 |

| 57 | Sitecore | DK | 112.4 | 112.4 | 190 | |

| 58 | ESI Group | FR |  |

111.0 | 111.0 | 317 |

| 59 | Anite | UK |  |

108.9 | 146.9 | 205 |

| 60 | Berger-Levrault | FR | 107.0 | 122.8 | 239 | |

| 61 | Vizrt | NO |  |

106.5 | 106.5 | 140 |

| 62 | GFI Informatique | FR |  |

106.3 | 804.0 | 238 |

| 63 | Personal & Informatik | DE |  |

102.9 | 105.5 | 135 |

| 64 | msg life | DE |  |

102.7 | 104.3 | 83 |

| 65 | Avanquest Software | FR |  |

101.6 | 101.6 | 103 |

| 66 | Digia | FI |  |

97.4 | 97.4 | 150 |

| 67 | ISAGRI | FR | 95.0 | 140.0 | 250 | |

| 68 | Automic | AT | 92.7 | 92.7 | 119 | |

| 69 | Raet | NL | 91.0 | 151.6 | 131 | |

| 70 | Gruppo Engineering | IT | 89.7 | 817.3 | 285 | |

| 71 | Comptel | FI |  |

85.7 | 85.7 | 126 |

| 72 | Lumesse | UK | 81.0 | 81.0 | 127 | |

| 73 | AFAS ERP Software | NL |  |

79.6 | 79.6 | 95 |

| 74 | Elca | CH | 79.1 | 83.8 | 70 | |

| 75 | SmartFocus | UK | 78.9 | 78.9 | 90 | |

| 76 | Buhl Data Service | DE | 78.0 | 78.0 | 115 | |

| 77 | Panda Security | SP | 75.2 | 75.2 | 200 | |

| 78 | IBS | SE | 75.2 | 75.2 | 200 | |

| 79 | Kewill Systems | UK | 74.3 | 74.3 | 100 | |

| 80 | Efront | FR | 72.0 | 72.0 | 78 | |

| 81 | Seeburger | DE | 70.0 | 70.0 | 120 | |

| 82 | ISIS Papyrus | AT | 70.0 | 70.0 | 75 | |

| 83 | ERI Bancaire | CH | 65.0 | 65.0 | 95 | |

| 84 | Lectra | FR |  |

63.4 | 211.3 | 260 |

| 85 | Aditro | SE | 62.4 | 124.8 | 240 | |

| 86 | SSP Holding | UK | 62.2 | 88.9 | 70 | |

| 87 | InfoVista | FR | 61.0 | 61.0 | 118 | |

| 88 | proALPHA | DE | 60.3 | 60.3 | 90 | |

| 89 | Cassiopae | FR | 55.5 | 55.5 | 220 | |

| 90 | Hogia Group | SE | 54.9 | 54.9 | 120 | |

| 91 | Talentia | FR | 54.3 | 54.3 | 81 | |

| 92 | Meta4 | SP | 54.0 | 54.0 | 90 | |

| 93 | IRIS | UK | 53.6 | 53.6 | 180 | |

| 94 | Schleupen | DE | 53.5 | 61.5 | 110 | |

| 95 | Fiducial Informatique | FR | 49.5 | 61.9 | 115 | |

| 96 | Generix Group | FR |  |

49.4 | 49.4 | 48 |

| 97 | Talend | FR | 48.7 | 48.7 | 157 | |

| 98 | ENEA | SE |  |

47.2 | 47.2 | 118 |

| 99 | intershop Communications | DE |  |

46.2 | 46.2 | 125 |

| 100 | Thunderhead | UK | 41.7 | 41.7 | 125 |