Editorials

Neelie Kroes

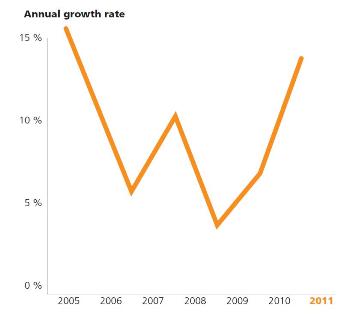

This latest Truffle 100 report shows that Europe's software sector has had yet another exciting year.Most encouragingly, even in these times of economic uncertainty, the sector has clearly remained a reliable pillar underpinning Europe's economic growth. Not only has the market grown by about 10% year on year but,more importantly, vendors are planning to increase headcounts and R&D investments. These are exactly the right ingredients to sustain the industry's momentum in years to come. The importance of the industry, however, is not just economic: because innovation in software and ICT services also helps address Europe's societal challenges, creating amore equitable and sustainable future for citizens.

Still, a lot remains to be done to maximise the potential of Europe's software industry.We have great ideas, with products pouring out from both established players and the next generation. However we need to go further to help newcomers develop into high growth companies. In particular, we need to overcome the barriers which stand in the way of a European digital single market.

The European Commission is working hard to boost innovation. Our Digital Agenda for Europe, now one year old, aims to improve the environment for ICT investment in Europe.

The Agenda is an action plan to catalyse development, fuel demand and power supply-side investments in ICT. It will ensure roll-out of high speed broadband infrastructure, strengthen the digital singlemarket, encourage venture capital and other financial support, and promote more open standards and interoperability. It also seeks to develop the public markets where ICT can support policy challenges, like energy efficiency, health care and smart mobility.

Alongside that, Horizon 2020, the Commission's new research and innovation programme for 2014-2020, will make the framework for R&D and innovation support more flexible and integrated; and the Commission's proposed infrastructure fund, the "Connecting Europe Facility", will invest 9.2 billion euros in the deployment of broadband network and digital services infrastructure.

You can depend on me to domy share in creating the best environment for Europe's software industry to thrive. I hope we can count on the support and entrepreneurship of the Truffle 100's current and future members to achieve these goals.

Bernard-Louis Roques

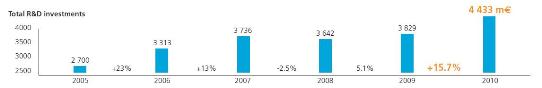

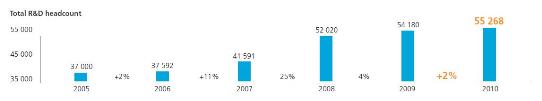

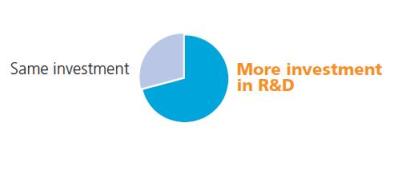

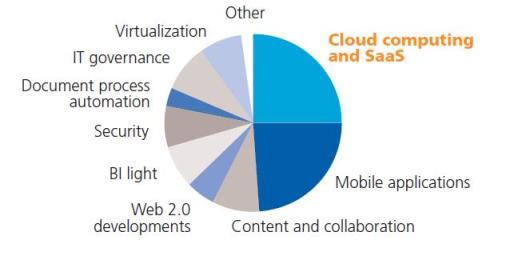

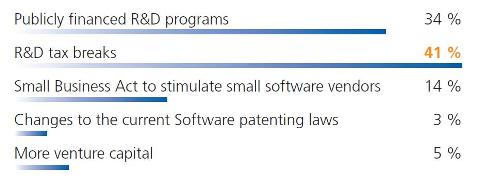

We are pleased to present the 6th edition of the Truffle 100 Europe,which once again highlights the impressive dynamism and exceptional resilience of the European software industry. Software vendors are able to bounce back quickly (with year-on-year growth of 14%) and generate profits (€3.7 billion last year),while investing heavily in R&D (€4.4 billion). With over 55,000 highly qualified R&D jobs, they constitute a strategic industry that is absolutely critical for employment & GDP growth in Europe. With cloud computing and "software as a service" (SAAS) bound to radically transformthe industry in the coming years, Europe's software vendors are on the verge of a major paradigm shift and deserve a lot more attention. On-going changes in business models mean that this is a highly critical period for vendors. European governments must accentuate supporting measures, so that more money is channelled into R&D and thousands of added-value jobs are created. The Truffle 100 reveals that software vendors are clamouring for the implementation of R&D tax incentives (with the effect of leveraging investment in R&D), a European Small Business Act (whereby a fraction of public procurement is systematically allocated to small businesses) and publiclyfunded R&D programmes with facilitated access and simplified procedures for SMEs. I am convinced that Europe's industrial future, economic growth and technological independence rely on its ability to develop a solid, sustainable software industry.

I wish to thank Commissioner Kroes, CXP and IDC for their commitment to and support for the Truffle 100.

Franck Cohen

This latest edition of the Truffle 100 arrives in turbulent economic times where Europe has to overcome a strong crisis. In this volatile market, the ranking of the top 100 European software vendors underlines the dynamism of the software industry. It also demonstrates how important the software industry is to Europe's future to ensure sustainable growth in a highly competitive global economy.

In this ever-changing environment, innovation is crucial to remain competitive while technology is the foundation for sustainable growth. Today, software companies are the ones that drive innovation across all industries and their goal is to increase headcount and R&D investments in 2012.

To drive this innovation, software vendors count on public support through R&D tax breaks & public R&D programs. With that said, we strongly encourage the European Union to develop a software industry policy with pan-European R&D projects.

The demand for sustainable business solutions will continue to increase to reach the right balance between economic and environmental demands. Companies are always looking for a better user interface to transform and improve their end-to-end business processes in a sustainable fashion.

In light of customer expectations that are constantly changing, our industry has to manage a significant paradigm shift. The appetite for technology is astonishing because technology together with connectivity empowers people to connect across the globe, share their views and ideas, and do business differently. This is the era of social media where users of online social and business communities are collaborating across company boundaries at amazing speeds via digital environments using their smart phones. This allows them to be more efficient, more productive, and make the right decisions in less time. This paradigm shift also includes a new way to consume software with cloud computing and On Demand solutions.

SAP is again at the forefront of this major shift in the IT sector, away from commoditized hardware and toward renewed investment in differentiating IT: business software that drives efficiency, agility and growth.

SAP business software, unwired by mobile apps and fueled by in-memory and advanced analytics, is reshaping the business IT world with innovation that drives value and growth for customers, partners, and entire markets. With state-of-the-art technologies that offer speed, mobility, and insights - SAP allows customers to truly put their Business in the Moment. From the boardroom to front lines of global markets across all industries, SAP helps companies better understand and more quickly act upon customer demands, unexpected events and new opportunities.

We are lucky to be part of the software industry where the rules of the game are constantly changing thus allowing for constant growth opportunities.

Karl-Heinz Streibich

This latest edition of the Truffle 100 is being published in times of economic uncertainty with many economies failing to return to sustainable growth after the worst global recession in many decades. While the depth and duration of the current economic turbulence cannot be foreseen, there is one significant, positive aspect. That is, that the European software industrywill once again prove to be an economic stimulus in terms of growth, of increased high-value employment and as a driver of innovation across all industries.

The Truffle 100 - 2011 supports this conclusion. The annual growth rate of Europe's top 100 software companies in 2010 was more than five times that of the total European Union economy. This continues the resilience the European software industry demonstrated during the last recession. Secondly the software industry will increase Research and Development investments and employment over the coming year.

This is a cause for much optimism. The commitment of the European software industry to growth and to driving innovation throughout the economy fully demonstrates the contribution it can make to building a stronger Europe.

The Truffle report also highlights the industry-wide call for public-private partnerships to further drive expansion through joint R&D programs and lighthouse projects. In Germany we have established such partnerships in the Software Cluster and the House of IT. These have been important steps in strengthening the software industry in Germany.

I can fully endorse this call at a European level.

Laurent Calot

Although Europe is going through a period of major economic turbulence, the software industry has shown itself to be a reliable, federating asset. After monitoring trends in the software sector for almost 40 years and having collaborated with Truffle Capital since the first edition of the Truffle 100, we are still impressed by the industry's eternally renewed dynamism and inventiveness year after year.

Bo Lykkegaard

In 2010 and 2011, we saw the European software industry undergo continuing globalization and specialization. These two aspects are closely interconnected for European ISVs, since a high degree of specialization is needed for global competitiveness. We have seen ISVs divest unrelated software businesses and/or acquire well-matched companies to deepen their functional capabilities. HP's acquisition of UK-based Autonomy is a loss to the European software industry but major acquisitions in the other direction have also happened, such as Sweden-based Hexagon's $2.1-billion acquisition of US-based Intergraph and SAP's $5.8 billion acquisition of Sybase in 2010. We find that European ISVs have particular strengths in horizontal business applications, engineering applications, and industry-specific applications and we believe that these areas will continue to be strongholds for Europe's software industry.

Figures

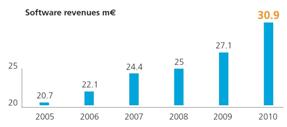

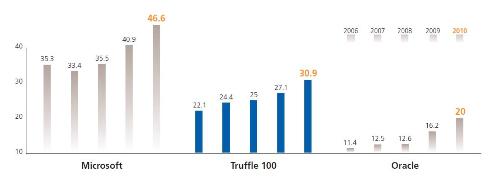

- Software revenues 30.9 bn€ (up from 27.1 bn€ last year)

Total revenues for the Truffle 100 are 49.4 bn€

63 % of revenues come from the top 25 vendors(79% last year)% Revenues 2009 2010 SAP

40 % 31 % TOP 3 50 % 40 % TOP 5 56 % 44 % TOP 10 65 % 52 % TOP 50 91 % 84 %

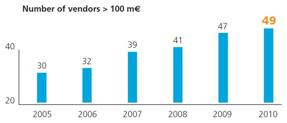

49 vendors have revenues > 100 m€

they account for 89.2 % of Truffle 100 revenues

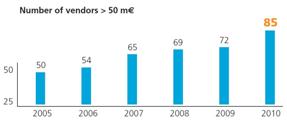

85 vendors have revenues > 50 m€

they account for 97.8 % of Truffle 100 revenues

All Truffle 100 have revenues > 25 m€

- World-class national champions

Vendor Country Revenues (m€) % of

Truffle 100SAP DE 12 337 39.8 % Dassault Systemes

FR 1 564 5.0 % Sage

UK 1 543 5.0 % Software AG DE 919 3.0 % DATEV DE 685 2.2 % - Fierce global competition

- Growth

… 14 % growth

Revenues growth year on year:+14 %

- Strong exposition to capital markets

Public or non-public # Software

Revenues (€M)% of

Truffle 100R&D

Spend (€M)% of

Truffle 100Publicly traded

65 26 176 84.5 % 3 803 85.8 % Private 35 4 810 15.5 % 630 14.2 % Total 100 30 985 100 % 4 433 100 %

- Profits

Profits on the rise

5.8 bn€ aggregated net profits,

up from 3.7 bn€ last yearProfits bn€ 2006 2007 2008 2009 2010 2.8 3.2 3.6 3.7 5.8

% of revenues % of profits Truffle 100 2010 2009 2008 2007 SAP 40% 31% 46% 51% 60% TOP 3 50% 40% 58% 62% 73% TOP 5 55% 44% 66% 67% 75% TOP 10 36% 52% 66% 67% 75% TOP 50 90% 84% 91% 92% 95% Big vendors more profitable

Small vendors catching up

Profitability m€ 2010 % of revenues 2009 TOP 3 2.386 15.2 % 16.0 % TOP 50 4.952 12.2 % 10.7 % BOTTOM 50 0.940 10.6 % 6.8 % BOTTOM 25 0.228 13.4 % 8.6 % - Breakdown by country

Breakdown by country

Countries Software revenues

(€ millions)% of total # Software

companiesGermany 15 578 50.3% 16 UK 5 752 18.6% 24 France 3 482 11.2% 18 Netherlands 1 093 3.5% 7 Sweden 977 3.2% 4 Norway 436 1.4% 5 Finland 661 2.1% 2 Italy 522 1.7% 8 Switzerland 881 2.8% 7 Belgium 511 1.6% 1 Poland 562 1.8% 4 Denmark 185 0.6% 1 Czech Republic 166 0.5% 1 Spain 117 0.4% 1 Austria 62 0.2% 1

R&D and Jobs

~ 4.4 bn€ invested in R&D

55 000 R&D jobs

| Countries | Number R&D employees |

% of total |

R&D investment (m€) |

% of total |

|---|---|---|---|---|

| Germany | 20 416 | 39.9% | 2 147 | 48% |

| UK | 10 573 | 19.1% | 842 | 19% |

| France | 8 096 | 14.6% | 561 | 13% |

| Netherlands | 3 774 | 6.8% | 144 | 3% |

| Sweden | 2 801 | 5.1% | 167 | 4% |

| Norway | 1 056 | 1.9% | 62 | 1% |

| Finland | 1 322 | 2.4% | 94 | 2% |

| Italy | 1 378 | 2.5% | 74 | 1.7% |

| Switzerland | 1 499 | 2.7% | 125 | 2.8% |

| Belgium | 452 | 0.8% | 54 | 1.2% |

| Poland | 3 147 | 5.7% | 87 | 2.0% |

| Denmark | 283 | 0.5% | 26 | 0.6% |

| Czech Republic | 150 | 0.3% | 24 | 0.5% |

| Spain | 212 | 0.4% | 17 | 0.4% |

| Austria | 110 | 0.2% | 9 | 0.2% |

Major M&A transactions

Trends

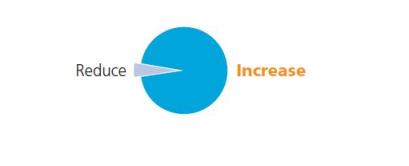

R&D investments trend for 2012 ?

Headcount in 2012

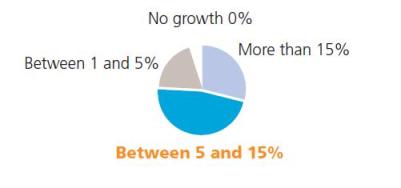

Expected growth rate for 2012 ?

Main technological trends for 2012 ?

Measures: Tax breaks and SBA needed

What measures should be adopted to serve the cause of european software industry?

(multiple answers possible)

European software vendors ranking 2011

| Rank | Company | Public ? | Country of HQ location |

Software revenues 2010 (m€) |

Total revenues 2010 (m€) |

R&D employees 2010 |

| 1 | SAP |  |

DE | 12 336.7 | 12 464.0 | 14 991 |

| 2 | Dassault Systemes |  |

FR | 1 563.8 | 1 563.8 | 3 700 |

| 3 | Sage |  |

UK | 1 542.9 | 1 688.4 | *2 076 |

| 4 | Software AG |  |

DE | 919.2 | 1 119.5 | 850 |

| 5 | DATEV | DE | 684.6 | 698.6 | *1 250 | |

| 6 | Autonomy |  |

UK | 657.0 | 657.0 | *563 |

| 7 | Asseco |  |

PL | 516.4 | 808.5 | *2 047 |

| 8 | SWIFT | BE | 511.1 | 538.0 | *452 | |

| 9 | Wincor Nixdorf |  |

DE | 461.6 | 2 239.0 | *372 |

| 10 | Misys |  |

UK | 431.2 | 431.2 | *1 102 |

| 11 | Unit4 |  |

NL | 421.7 | 421.7 | 1 150 |

| 12 | Sopra Group / Axway |  |

FR | 354.7 | 1 169.9 | 1 000 |

| 13 | Temenos Group |  |

CH | 338.2 | 338.2 | *617 |

| 14 | Swisslog |  |

CH | 324.9 | 444.3 | *511 |

| 15 | Micro Focus |  |

UK | 322.7 | 329.2 | *300 |

| 16 | Compugroup Holding |  |

DE | 312.4 | 312.4 | *900 |

| 17 | Murex | FR | 310.0 | 310.0 | 255 | |

| 18 | Invensys |  |

UK | 279.2 | 2 897.1 | 1 328 |

| 19 | NIS (Northgate Information Solutions) | UK | 269.0 | 780.9 | *760 | |

| 20 | IFS |  |

SE | 264.0 | 270.8 | 524 |

| 21 | Acision | UK | 260.4 | 434.1 | 486 | |

| 22 | Sophos | UK | 259.4 | 259.4 | *600 | |

| 23 | Fidessa |  |

UK | 228.8 | 305.7 | *300 |

| 24 | Exact |  |

NL | 228.2 | 228.2 | 456 |

| 25 | Cegid |  |

FR | 218.0 | 249.6 | 537 |

| 26 | Visma | NO | 208.2 | 520.6 | *720 | |

| 27 | Zucchetti | IT | 205.0 | 237.0 | *380 | |

| 28 | Reply |  |

IT | 202.8 | 384.2 | *552 |

| 29 | AVEVA Group |  |

UK | 187.2 | 187.2 | 248 |

| 30 | SimCorp |  |

DK | 185.4 | 185.4 | *283 |

| 31 | Qliktech |  |

SE | 171.0 | 171.0 | 96 |

| 32 | AVG Technologies | CZ | 166.1 | 166.1 | *150 | |

| 33 | Hexagon |  |

SE | 165.6 | 1 487.1 | *1 300 |

| 34 | Civica | UK | 164.8 | 196.9 | *310 | |

| 35 | Kofax |  |

UK | 162.9 | 258.5 | 457 |

| 36 | Gemalto |  |

NL | 152.0 | 1 905.6 | *1 470 |

| 37 | Nemetschek |  |

DE | 149.3 | 149.7 | 484 |

| 38 | RM |  |

UK | 147.9 | 443.0 | *280 |

| 39 | PSI |  |

DE | 143.5 | 158.7 | *284 |

| 40 | Torex | UK | 137.6 | 217.5 | *240 | |

| 41 | Linedata Services |  |

FR | 136.2 | 136.2 | 278 |

| 42 | Digia |  |

FI | 130.8 | 130.8 | *230 |

| 43 | F-Secure Corp. |  |

FI | 130.1 | 130.1 | 339 |

| 44 | GAD | DE | 129.0 | 645.0 | *255 | |

| 45 | Panda Security | SP | 116.5 | 116.5 | *212 | |

| 46 | Sword |  |

FR | 111.6 | 185.3 | *182 |

| 47 | Centric |  |

NL | 111.1 | 1 225.7 | *140 |

| 48 | IBS |  |

SE | 104.8 | 136.2 | 209 |

| 49 | Affecto |  |

FI | 103.6 | 114.1 | *142 |

| 50 | Lumesse | UK | 95.6 | 95.6 | *160 | |

| 51 | IRIS Software | UK | 93.2 | 93.2 | *138 | |

| 52 | SDL International |  |

UK | 92.5 | 237.2 | *311 |

| 53 | BasWare |  |

FI | 90.7 | 103.1 | 239 |

| 54 | GFI Informatique |  |

FR | 90.0 | 657.9 | 160 |

| 55 | ACS (Advanced Computer Software) |  |

UK | 88.3 | 111.2 | *170 |

| 56 | Avanquest Software |  |

FR | 88.2 | 88.2 | 150 |

| 57 | Avaloq | CH | 86.7 | 86.7 | *200 | |

| 58 | Opera Software |  |

NO | 86.5 | 86.5 | *119 |

| 59 | ESI Group |  |

FR | 84.2 | 84.2 | 240 |

| 60 | Aditro | SE | 83.8 | 167.0 | *320 | |

| 61 | ORC Software |  |

SE | 83.1 | 102.3 | *87 |

| 62 | Wolters Kluwer (CCH & A3 Software) |  |

NL | 82.7 | 3 556.0 | *365 |

| 63 | Vizrt |  |

NO | 79.7 | 79.7 | *117 |

| 64 | ERI Bancaire | CH | 79.5 | 79.5 | *106 | |

| 65 | Comptel |  |

FI | 77.9 | 77.9 | 177 |

| 66 | ISAGRI | FR | 75.0 | 75.0 | 200 | |

| 67 | Cegedim |  |

FR | 74.0 | 74.0 | 150 |

| 68 | Berger-Levrault | FR | 74.0 | 95.0 | 205 | |

| 69 | Anite |  |

UK | 72.0 | 109.2 | *117 |

| 70 | LHS AG (part of Ericsson) |  |

DE | 71.6 | 71.6 | *213 |

| 71 | Aldata Solutions |  |

FI | 70.2 | 73.1 | 103 |

| 72 | Kewill Systems |  |

UK | 69.9 | 69.9 | *136 |

| 73 | Gruppo Engineering | IT | 69.8 | 738.3 | 324 | |

| 74 | Generix Group |  |

FR | 69.0 | 69.0 | 160 |

| 75 | Mensch und Maschine |  |

DE | 67.9 | 195.6 | *150 |

| 76 | Personal & Informatik |  |

DE | 66.6 | 69.1 | 133 |

| 77 | UC4 | AT | 62.0 | 62.0 | *110 | |

| 78 | Mamut |  |

NO | 61.3 | 61.3 | *100 |

| 79 | ReadSoft |  |

SE | 60.5 | 64.8 | *115 |

| 80 | Tekla |  |

FI | 57.8 | 57.8 | *92 |

| 81 | SSP Holding | UK | 57.4 | 82.0 | *120 | |

| 82 | Lectra |  |

FR | 53.5 | 190.3 | 210 |

| 83 | CSB-System | DE | 52.0 | 52.0 | *80 | |

| 84 | Elca | CH | 51.3 | 55.5 | 65 | |

| 85 | AFAS ERP Software | NL | 50.2 | 50.2 | 73 | |

| 86 | HR Access | FR | 49.2 | 69.6 | *150 | |

| 87 | proALPHA | DE | 48.5 | 49.3 | *120 | |

| 88 | Beta Systems Software |  |

DE | 47.6 | 47.6 | 113 |

| 89 | Cordys | NL | 47.2 | 47.2 | *120 | |

| 90 | Smartstream | UK | 46.4 | 62.9 | *90 | |

| 91 | Comarch |  |

PL | 45.9 | 191.1 | 1 100 |

| 92 | CAD It |  |

IT | 44.6 | 52.5 | *122 |

| 93 | Hogia Group | SE | 44.2 | 44.2 | *150 | |

| 94 | Groupe SAB | FR | 44.2 | 44.2 | 320 | |

| 95 | Schleupen | DE | 44.1 | 55.1 | *70 | |

| 96 | Fiducial Informatique | FR | 43.4 | 54.6 | 122 | |

| 97 | COR&FJA |  |

DE | 43.2 | 116.2 | *150 |

| 98 | Alterian |  |

UK | 43.1 | 43.1 | *110 |

| 99 | InfoVista |  |

FR | 43.0 | 43.0 | 77 |

| 100 | Delcam |  |

UK | 42.7 | 42.7 | *170 |

(*) R&D headcount 2010 estimated

Software revenues: software revenues + related services